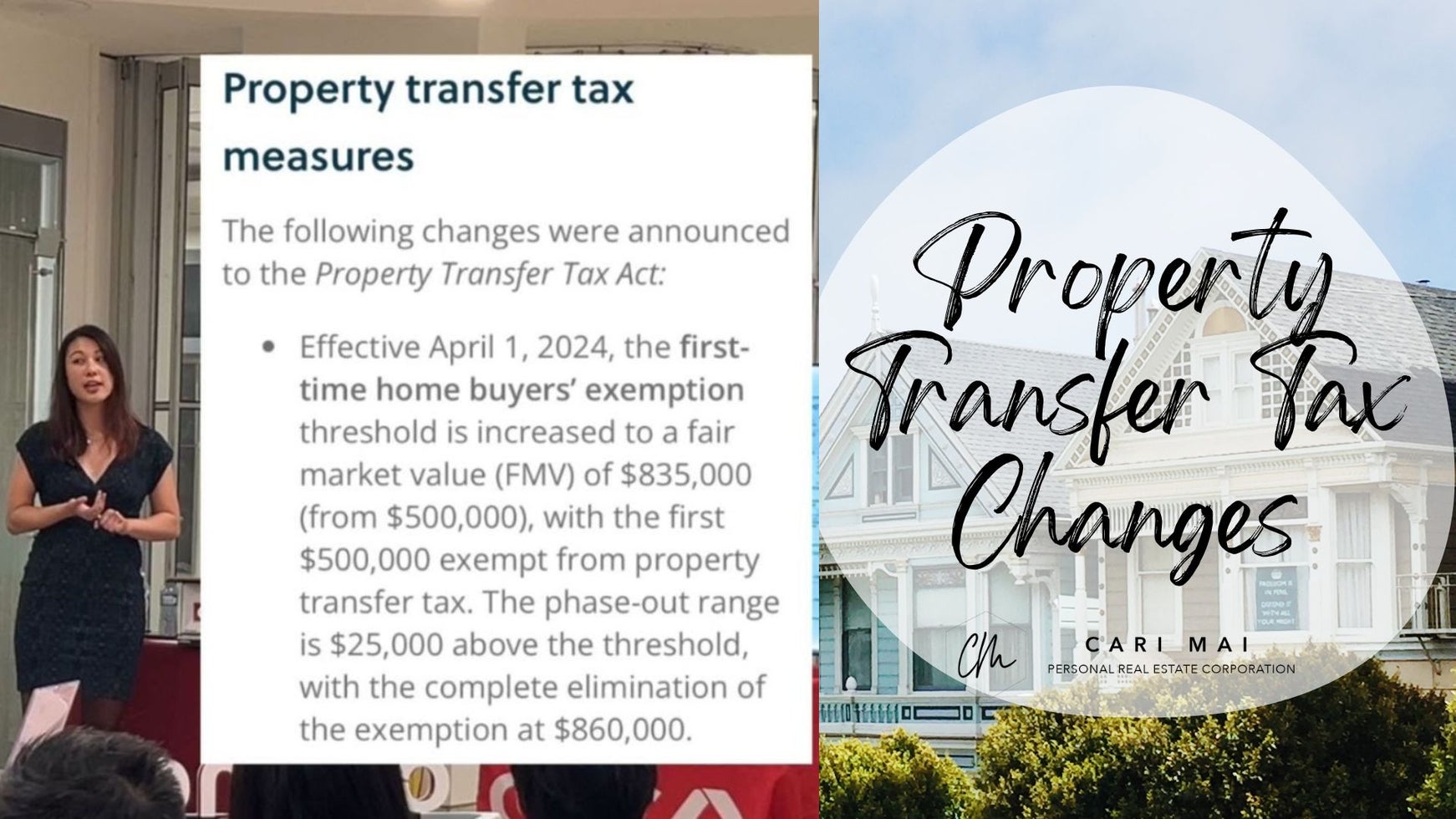

Significant changes to the Property Transfer Tax (PTT) exemptions have been announced, effective from April 1, 2024, and they're set to make a big impact on the BC real estate market.

First Time Home Buyers Exemption: The threshold for PTT exemption has been raised substantially. Previously capped at homes valued up to $500,000, first-time buyers will now enjoy PTT exemptions for properties up to $835,000, with the first $500,000 completely exempt. For homes priced between $500,000 and $835,000, PTT will apply only to the value exceeding $500,000. However, for properties over $860,000, the exemption phases out, and full PTT applies.

Newly Built Homes Exemption: The exemption for newly built homes has also seen a generous increase. Buyers of new homes can now benefit from a full PTT exemption on properties valued up to $1,100,000, up from the previous $750,000 cap. Homes priced between $1,100,000 and $1,150,000 will qualify for a partial exemption. Above $1,150,000, the full PTT rate will be charged.

Boosting Rental Housing Development: Starting January 1, 2025, through December 31, 2030, a new incentive comes into play for the development of rental housing. Purchases of qualifying purpose-built rental buildings will be exempt from PTT. To qualify, these buildings must be dedicated to rental housing and contain at least four units. This move, coupled with the federal government’s decision to remove the 5% GST on new rental developments, aims to lower construction costs and encourage more rental housing projects.

These changes represent a significant shift in the Vancouver real estate landscape, offering more opportunities for prospective BC homeowners. By adjusting the PTT exemptions, the government is aiming to make home ownership more accessible and stimulate rental housing development.